personal property tax richmond va due date

Richmond city officials on Monday will introduce legislation to push the June 5 due date for personal property tax bills to Aug. Personal property taxes are due May 5 and October 5.

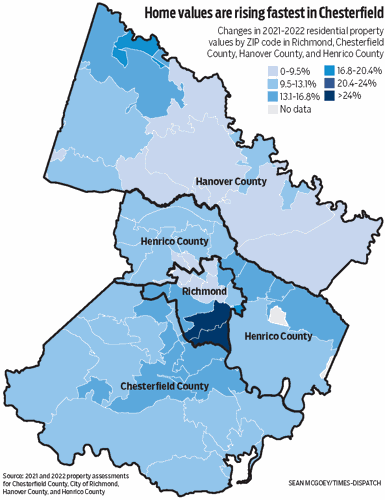

Chesterfield Extends Payment Deadline For Personal Property Taxes To July 29

Pay bills or set up a payment plan for all individual and business taxes.

. Property Taxes are due once a year in Richmond on the first business day of July. Personal property tax bills which can apply to cars. WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the.

Billing is on annual basis and payments are due on December 5 th of each year. Any real property owner can protest a. Richmond personal property tax payment deadline extended until Aug.

Personal property tax bills have been mailed are available online and currently are due June 5 2022. Chesterfield County officials announced on Monday that the new deadline for residents to pay their personal property taxes is July 29. Broad Street Room 100 Richmond VA.

Late payment penalty of 10 is applied on. Taxpayers can either pay. Richmond residents will have until July 4 to pay their property.

Monday July 4 2022. 5 As Richmond residents see an increase in their personal property tax bills Richmond City Council. There are three basic steps in taxing property ie formulating levy rates assigning property market values and collecting tax revenues.

Use the map below to find your city or countys. Under Virginia law the government of Richmond. Tax rates differ depending on where you live.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. WRIC The City of Richmond has extended the due date for personal property tax to early August. Tax payers have until August 5 to pay the personal.

If you have questions about personal property tax or real estate tax contact your local tax office. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. In the event you need to defend your position in the court it may make sense to get service of one of the best property tax attorneys in Richmond City VA.

Real Estate taxes are assessed as of January 1 st of each year.

5951 Fairlee Rd Richmond Va 23225 Mls 2215459 Redfin

Property Tax Payment History Treasurer And Tax Collector

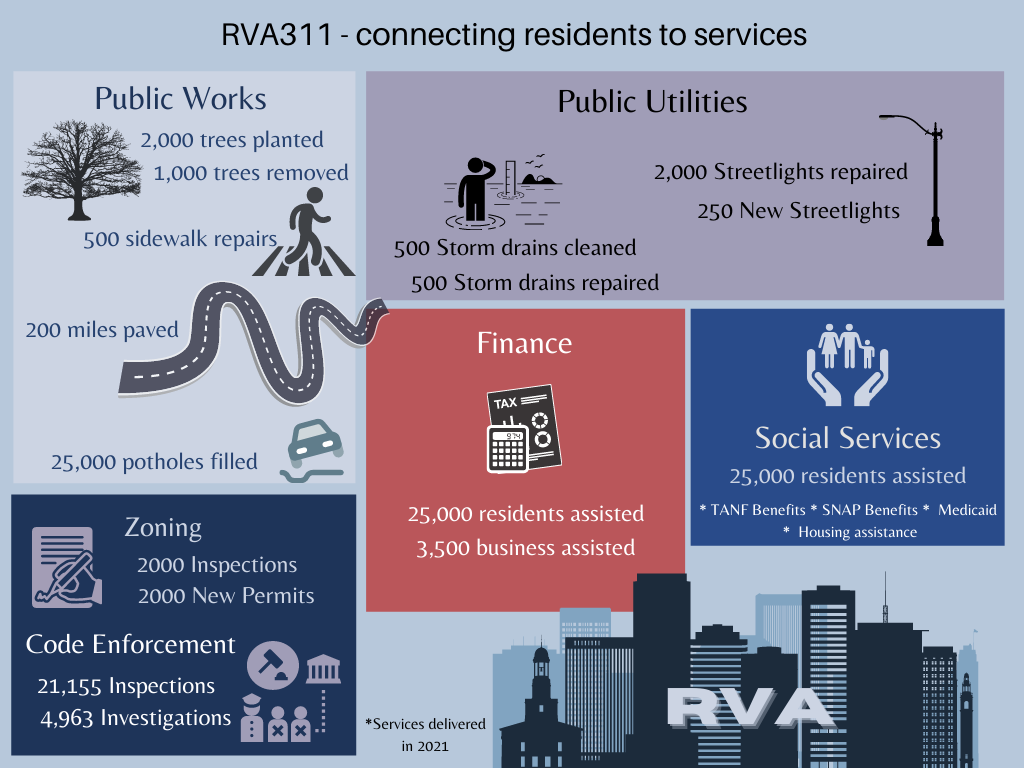

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Due And Payable It S Time To Open Those Property Tax Bills

Understanding Your Property Tax Bill Davie County Nc Official Website

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

Retail Sales And Use Tax Virginia Tax

Chesterfield Extends Payment Deadline For Personal Property Taxes To July 29

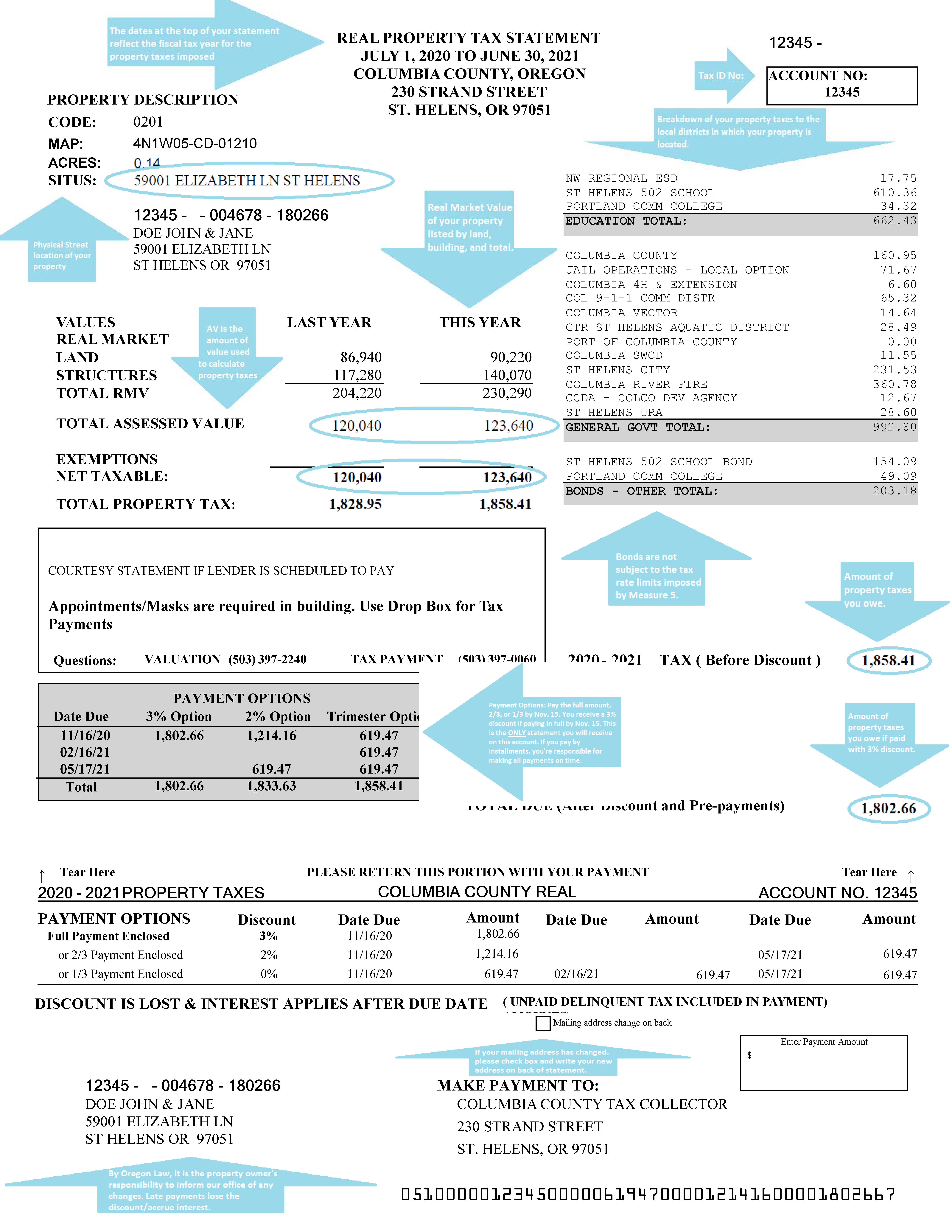

Understanding Your Property Tax Bill Clackamas County

Chesterfield Extends Payment Deadline For Personal Property Taxes To July 29

Columbia County Oregon Official Website Understanding Your Property Tax Statement

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

Cto Realty Growth Announces Acquisition Of Mixed Use Grocery Anchored Lifestyle Property In Richmond Virginia For 93 9 Million

The Property Tax Annual Cycle Myticor

Value Of Used Cars Impacting Personal Property Taxes Vpm

Henrico First To Give Money Back For Personal Property Taxes Under Revised State Law

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Many Left Frustrated As Personal Property Tax Bills Increase